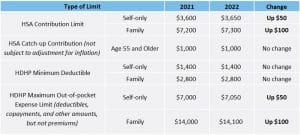

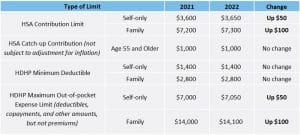

Amounts paid for long-term care coverage. Any excess contribution remaining at the end of a tax year is subject to the excise tax. 254, available at IRS.gov/irb/2007-2_IRB/ar09.html. Go to IRS.gov/Notices to find additional information about responding to an IRS notice or letter. Next, complete a controlling Form 8889 combining the amounts shown on each of the statement Forms 8889. You include this amount in your income in the year in which you fail to be an eligible individual. The contributions remain in your Archer MSA from year to year until you use them. Also, the IRS offers Free Fillable Forms, which can be completed online and then filed electronically regardless of income. If you have a tax question not answered by this publication or the, Distributions may be tax free if you pay qualified medical expenses. The carryover doesn't affect the maximum amount of salary reduction contributions that you care permitted to make. The employer may also contribute. The excise tax applies to each tax year the excess contribution remains in the account. For 2022, the maximum contribution for individuals is $3,650. WebSo if you turn 65 on June 21, you may not contribute to your HSA after June 1.  You must reduce the amount that can be contributed (including any additional contribution) to your HSA by the amount of any contribution made to your Archer MSA (including employer contributions) for the year. These are explained in Pub. The HRA doesnt pay or reimburse, at any time, the medical expenses incurred during the suspension period except preventive care and items listed under, Coverage during a grace period by a general purpose health FSA is allowed if the balance in the health FSA at the end of its prior year plan is zero. WebCatch-Up Contributions As in prior years, HSA account owners aged 55 and older may contribute an additional $1,000 over the standard annual limit. The maximum out-of-pocket is capped at $7,050. Source: IRS How does the HSA last-month rule help you save money? An HDHP may provide preventive care benefits without a deductible or with a deductible less than the minimum annual deductible. Ways to check on the status of your refund. Generally, contributed amounts that arent spent by the end of the plan year are forfeited. You will generally pay medical expenses during the year without being reimbursed by your HDHP until you reach the annual deductible for the plan. The following situations result in deemed taxable distributions from your HSA. Suspended HRA. The total excess contributions in your HSA at the beginning of the year. Archer MSAs were created to help self-employed individuals and employees of certain small employers meet the medical care costs of the account holder, the account holders spouse, or the account holders dependent(s). 123, questions 23 through 27, available at IRS.gov/irb/2008-29_IRB/ar11.html. This publication explains the following programs. If you want your employees to be able to have HSAs, they must have an HDHP. WebThe IRS published 2022 HSA contribution limits, HDHP minimum deductibles, and annual out-of-pocket limits on Monday, May 10. Contributions made by your employer and qualified HSA funding distributions are also shown on the form. The plan may specify a lower dollar amount as the maximum carryover amount. See, If you are an eligible individual who is age 55 or older at the end of your tax year, your contribution limit is increased by $1,000. This amount is also subject to a 10% additional tax. Because you have family HDHP coverage on December 1, 2022, you contribute $7,300 for 2022. Adults 55 and over can make an additional catch-up contribution of $1,000. You have an HDHP for your family for the entire period of July through December 2022 (6 months). See Balance in an HRA, later. A qualified HSA trustee can be a bank, an insurance company, or anyone already approved by the IRS to be a trustee of individual retirement arrangements (IRAs) or Archer MSAs. This includes requests for personal identification numbers (PINs), passwords, or similar information for credit cards, banks, or other financial accounts. An employee covered by an HDHP and a health FSA or an HRA that pays or reimburses qualified medical expenses cant generally make contributions to an HSA. TAS can help you resolve problems that you cant resolve with the IRS. .Certain limitations may apply if you are a highly compensated participant. Go to Disaster Assistance and Emergency Relief for Individuals and Businesses to review the available disaster tax relief. The IRS will provide any further updates as soon as they are available at IRS.gov/Coronavirus. Access your tax records, including key data from your most recent tax return, and transcripts. Post-deductible health FSA or HRA. You can provide no additional coverage other than those exceptions listed earlier under Other health coverage. WebWhat are the 2022 HSA Contribution Limits Over 55? On IRS.gov, you can get up-to-date information on current events and changes in tax law.. IRS.gov/Help: A variety of tools to help you get answers to some of the most common tax questions. The Social Security Administration (SSA) offers online service at SSA.gov/employer for fast, free, and secure online W-2 filing options to CPAs, accountants, enrolled agents, and individuals who process Form W-2, Wage and Tax Statement, and Form W-2c, Corrected Wage and Tax Statement. If your SSN has been lost or stolen or you suspect youre a victim of tax-related identity theft, you can learn what steps you should take. WebFamily health plan. Your contributions are comparable if they are either: The same percentage of the annual deductible limit under the HDHP covering the employees. .If another taxpayer is entitled to claim you as a dependent, you cant claim a deduction for an Archer MSA contribution. The trustee will report any distribution to you and the IRS on Form 1099-SA, Distributions From an HSA, Archer MSA, or Medicare Advantage MSA. There is an additional 20% tax on the part of your distributions not used for qualified medical expenses.

You must reduce the amount that can be contributed (including any additional contribution) to your HSA by the amount of any contribution made to your Archer MSA (including employer contributions) for the year. These are explained in Pub. The HRA doesnt pay or reimburse, at any time, the medical expenses incurred during the suspension period except preventive care and items listed under, Coverage during a grace period by a general purpose health FSA is allowed if the balance in the health FSA at the end of its prior year plan is zero. WebCatch-Up Contributions As in prior years, HSA account owners aged 55 and older may contribute an additional $1,000 over the standard annual limit. The maximum out-of-pocket is capped at $7,050. Source: IRS How does the HSA last-month rule help you save money? An HDHP may provide preventive care benefits without a deductible or with a deductible less than the minimum annual deductible. Ways to check on the status of your refund. Generally, contributed amounts that arent spent by the end of the plan year are forfeited. You will generally pay medical expenses during the year without being reimbursed by your HDHP until you reach the annual deductible for the plan. The following situations result in deemed taxable distributions from your HSA. Suspended HRA. The total excess contributions in your HSA at the beginning of the year. Archer MSAs were created to help self-employed individuals and employees of certain small employers meet the medical care costs of the account holder, the account holders spouse, or the account holders dependent(s). 123, questions 23 through 27, available at IRS.gov/irb/2008-29_IRB/ar11.html. This publication explains the following programs. If you want your employees to be able to have HSAs, they must have an HDHP. WebThe IRS published 2022 HSA contribution limits, HDHP minimum deductibles, and annual out-of-pocket limits on Monday, May 10. Contributions made by your employer and qualified HSA funding distributions are also shown on the form. The plan may specify a lower dollar amount as the maximum carryover amount. See, If you are an eligible individual who is age 55 or older at the end of your tax year, your contribution limit is increased by $1,000. This amount is also subject to a 10% additional tax. Because you have family HDHP coverage on December 1, 2022, you contribute $7,300 for 2022. Adults 55 and over can make an additional catch-up contribution of $1,000. You have an HDHP for your family for the entire period of July through December 2022 (6 months). See Balance in an HRA, later. A qualified HSA trustee can be a bank, an insurance company, or anyone already approved by the IRS to be a trustee of individual retirement arrangements (IRAs) or Archer MSAs. This includes requests for personal identification numbers (PINs), passwords, or similar information for credit cards, banks, or other financial accounts. An employee covered by an HDHP and a health FSA or an HRA that pays or reimburses qualified medical expenses cant generally make contributions to an HSA. TAS can help you resolve problems that you cant resolve with the IRS. .Certain limitations may apply if you are a highly compensated participant. Go to Disaster Assistance and Emergency Relief for Individuals and Businesses to review the available disaster tax relief. The IRS will provide any further updates as soon as they are available at IRS.gov/Coronavirus. Access your tax records, including key data from your most recent tax return, and transcripts. Post-deductible health FSA or HRA. You can provide no additional coverage other than those exceptions listed earlier under Other health coverage. WebWhat are the 2022 HSA Contribution Limits Over 55? On IRS.gov, you can get up-to-date information on current events and changes in tax law.. IRS.gov/Help: A variety of tools to help you get answers to some of the most common tax questions. The Social Security Administration (SSA) offers online service at SSA.gov/employer for fast, free, and secure online W-2 filing options to CPAs, accountants, enrolled agents, and individuals who process Form W-2, Wage and Tax Statement, and Form W-2c, Corrected Wage and Tax Statement. If your SSN has been lost or stolen or you suspect youre a victim of tax-related identity theft, you can learn what steps you should take. WebFamily health plan. Your contributions are comparable if they are either: The same percentage of the annual deductible limit under the HDHP covering the employees. .If another taxpayer is entitled to claim you as a dependent, you cant claim a deduction for an Archer MSA contribution. The trustee will report any distribution to you and the IRS on Form 1099-SA, Distributions From an HSA, Archer MSA, or Medicare Advantage MSA. There is an additional 20% tax on the part of your distributions not used for qualified medical expenses.  A health Flexible Spending Arrangement (FSA) allows employees to be reimbursed for medical expenses. A plan may allow either the grace period or a carryover, but it may not allow both. These may be offered in conjunction with other employer-provided health benefits. Know them. If you use a distribution from your HSA for qualified medical expenses, you dont pay tax on the distribution but you have to report the distribution on Form 8889. Their job is to ensure that every taxpayer is treated fairly and that you know and understand your rights under the Taxpayer Bill of Rights. .For this purpose, a child of parents that are divorced, separated, or living apart for the last 6 months of the calendar year is treated as the dependent of both parents whether or not the custodial parent releases the claim to the childs exemption.. .You cant deduct qualified medical expenses as an itemized deduction on Schedule A (Form 1040) that are equal to the tax-free distribution from your HSA.. You cant treat insurance premiums as qualified medical expenses unless the premiums are for any of the following. Get an Identity Protection PIN (IP PIN). Telehealth and other remote care coverage with plan years beginning before 2022 is disregarded for determining who is an eligible individual. .If you are no longer an eligible individual, you can still receive tax-free distributions to pay or reimburse your qualified medical expenses.. Generally, a distribution is money you get from your HSA. For HSA purposes, expenses incurred before you establish your HSA arent qualified medical expenses. The 2023 HSA contribution deadline is April 18th. IRS eBooks have been tested using Apple's iBooks for iPad. You fail to be an eligible individual in June 2023. Under the last-month rule, if you are an eligible individual on the first day of the last month of your tax year (December 1 for most taxpayers), you are considered an eligible individual for the entire year. See the examples below for more on this. The annual deductible was $6,000. You had an HDHP for your family for the entire year in 2022. 502, Medical and Dental Expenses. Retirement HRA. You, age 39, have self-only HDHP coverage on January 1, 2022. Debit cards, credit cards, and stored value cards given to you by your employer can be used to reimburse participants in a health FSA. The premiums for long-term care insurance (item (1)) that you can treat as qualified medical expenses are subject to limits based on age and are adjusted annually. The total excess contributions in your Archer MSA at the beginning of the year. Reimbursements from an HRA that are used to pay qualified medical expenses arent taxed. The distribution must be made directly by the trustee of the IRA to the trustee of the HSA. Amounts that remain at the end of the year are generally carried over to the next year (see Excess contributions, earlier). Qualified medical expenses are those expenses that would generally qualify for the medical and dental expenses deduction. For example, if your plan provides coverage substantially all of which is for a specific disease or illness, the plan isnt an HDHP for purposes of establishing an HSA.. You can have a prescription drug plan, either as part of your HDHP or a separate plan (or rider), and qualify as an eligible individual if the plan doesnt provide benefits until the minimum annual deductible of the HDHP has been met. If the use of these cards meets certain substantiation methods, you may not have to provide additional information to the HRA. They also include any qualified HSA funding distribution made to your HSA. .If you and your spouse each have a family plan, you are treated as having family coverage with the lower annual deductible of the two health plans. Traditional IRA income phase-out ranges for 2022 are: $68,000 to $78,000 - Single taxpayers covered by a workplace retirement plan; $109,000 to $129,000 - Figure the tax on Form 8853 and file it with your Form 1040, 1040-SR, or 1040-NR. An HDHP has: A maximum limit on the annual out-of-pocket medical expenses that you must pay for covered expenses. The HSA contribution limit for individuals or families covered by qualified high-deductible health plans is $3,650 are $7,300 in 2022, respectively. You change to family HDHP coverage on November 1, 2022. Rollovers arent subject to the annual contribution limits. A qualified HSA funding distribution may be made from your traditional IRA or Roth IRA to your HSA. The HSA contribution limit for individuals or families covered by qualified high-deductible health plans is $3,650 are $7,300 in 2022, respectively. Your contribution limit is $2,325 ($4,650 6 12). TAS can provide a variety of information for tax professionals, including tax law updates and guidance, TAS programs, and ways to let TAS know about systemic problems youve seen in your practice. Reimbursements may be tax free if you pay qualified medical expenses. 868, available at IRS.gov/pub/irs-irbs/irb20-22.pdf, for additional information. See Flexible Spending Arrangements (FSAs), later. Had an average of 200 or fewer employees each year after 1996. Dont post your social security number (SSN) or other confidential information on social media sites. The amount you or any other person can contribute to your HSA depends on the type of HDHP coverage you have, your age, the date you become an eligible individual, and the date you cease to be an eligible individual. You are covered under a high deductible health plan (HDHP), described later, on the first day of the month. These distributions are included in your income and are subject to the additional 20% tax, discussed later. Go to IRS.gov/VITA, download the free IRS2Go app, or call 800-906-9887 for information on free tax return preparation. Qualified medical expenses from your HRA include the following. These arrangements dont pay or reimburse any medical expenses incurred before the minimum annual deductible amount is met. For families, the amount is $7,300. An HRA must receive contributions from the employer only. The income and additional tax are calculated on Form 8889, Part III. Figure the tax on Form 8889 and file it with your Form 1040, 1040-SR, or 1040-NR. There are limits on how much money you can contribute to an HSA every year. .The rules for married people apply only if both spouses are eligible individuals.. Family members or any other person may also make contributions on behalf of an eligible individual. The excess contribution you can deduct in the current year is the lesser of the following two amounts. Allows members to carry The funds added to your account stay there until you choose to withdraw or roll it over; like a 401(k). Also, these arrangements can pay or reimburse preventive care expenses because they can be paid without having to satisfy the deductible. Recordkeeping. The First-Time Homebuyer Credit Account Look-up (IRS.gov/HomeBuyer) tool provides information on your repayments and account balance. If you want your employees to be able to have HSAs, they must have an HDHP. You cant receive distributions from your FSA for the following expenses. Contributions made by your employer arent included in your income. Medical Savings Accounts (Archer MSAs and Medicare Advantage MSAs). There are various types of tax return preparers, including enrolled agents, certified public accountants (CPAs), accountants, and many others who dont have professional credentials. Family HDHP coverage is HDHP coverage for an eligible individual and at least one other individual (whether or not that individual is an eligible individual). The Consolidated Appropriations Act (P.L. 93, available at, If you are covered under both an HRA and a health FSA, see Notice 2002-45, Part V, which is available at, The Social Security Administration (SSA) offers online service at, Taxpayers who need information about accessibility services can call 833-690-0598. There is no additional tax on distributions made after the date you are disabled, reach age 65, or die. WebThe IRS has announced the new health savings account limits for 2022. Beginning with the first month you are enrolled in Medicare, you cant contribute to an Archer MSA. IP PINs are six-digit numbers assigned to taxpayers to help prevent the misuse of their SSNs on fraudulent federal income tax returns. If you prefer, you can order your transcript by calling 800-908-9946. You will have excess contributions if the contributions to your Archer MSA for the year are greater than the limits discussed earlier. For an HRA to maintain tax-qualified status, employers must comply with certain requirements that apply to other accident and health plans. This is true even if the other person doesnt receive an exemption deduction for you because the exemption amount is zero for tax years 2018 through 2025.. .Each spouse who is an eligible individual who wants an HSA must open a separate HSA. You may enjoy several benefits from having an FSA. You are treated as having the same HDHP coverage for the entire year as you had on the first day of the last month if you didnt otherwise have coverage. Reporting and resolving your tax-related identity theft issues. A self-employed person (or the spouse of a self-employed person) who maintains a self-only or family HDHP. Individuals who are eligible for an HSA may make a contribution prior to April 18 and include it in their 2022 filing. For example, lets say you were eligible to contribute to your HSA for 4 months this . See Qualified reservist distributions, earlier. The medical expenses hadnt been taken as an itemized deduction in any year. These amounts may never be used for anything but reimbursements for qualified medical expenses. Family plans increased by $100 from 2021 to 2022. Employer contributions arent included in income. You must include the fair market value of the assets used as security for the loan as income on Form 1040, 1040-SR, or 1040-NR. Based on the annual deductible, the maximum contribution to your Archer MSA would have been $4,500 (75% (0.75) $6,000). Employers may also contribute. Have the same category of employment (either part-time or full-time). When you pay medical expenses during the year that arent reimbursed by your HDHP, you can ask the trustee of your HSA to send you a distribution from your HSA. You can have additional insurance that provides benefits only for the following items. .Plans in which substantially all of the coverage is through the items listed earlier arent HDHPs. WebCurrent and recent contribution limits for a variety of CamaPlan accounts including Traditional and Roth IRAs, Coverdell ESA and Health Savings Accounts. Before you visit, go to IRS.gov/TACLocator to find the nearest TAC and to check hours, available services, and appointment options. Excess contributions made by your employer are included in your gross income. The Accessibility Helpline can answer questions related to current and future accessibility products and services available in alternative media formats (for example, braille, large print, audio, etc.). No employment or federal income taxes are deducted from the contributions. Web2022 HSA contribution limits: An individual with coverage under a qualifying high-deductible health plan (deductible not less than $1,400) can contribute up to $3,650 up $50 from 2021 for the year to their HSA. Health FSAs are employer-established benefit plans. WebAn individual with family coverage under a qualifying high-deductible health plan (deductible not less than $2,800) can contribute up to $7,300 up $100 from 2021 for the year. IRS.gov/ITA: The Interactive Tax Assistant, a tool that will ask you questions and, based on your input, provide answers on a number of tax law topics. You set up an HSA with a trustee. Amounts that are covered under another health plan. Your account ceases to be an HSA as of January 1, 2022, and you must include the fair market value of all assets in the account as of January 1, 2022, on Form 8889. The expense must have been incurred on or after the date you are enrolled in the HRA. If you have questions about a tax issue; need help preparing your tax return; or want to download free publications, forms, or instructions, go to IRS.gov to find resources that can help you right away. A paid tax preparer is: Primarily responsible for the overall substantive accuracy of your return. Health Reimbursement Arrangements (HRAs). Unlike HSAs or Archer MSAs, which must be reported on Form 1040, 1040-SR, or 1040-NR, there are no reporting requirements for HRAs on your income tax return. On June 18, 2022, you make a qualified HSA funding distribution. Therefore, you are limited to a contribution of $2,500. Generally, you can claim contributions you made and contributions made by any other person, other than your employer, on your behalf, as a deduction. TAS can help you if: Your problem is causing financial difficulty for you, your family, or your business; You face (or your business is facing) an immediate threat of adverse action; or. Health FSA contribution and carryover for 2023. If you want your employees to be able to have Archer MSAs, you must make an HDHP available to them. See Form 5329. The maximum out-of-pocket is capped at $7,050. If any distribution is, or can be, made for other than the reimbursement of qualified medical expenses, any distribution (including reimbursement of qualified medical expenses) made in the current tax year is included in gross income. .You cant deduct qualified medical expenses as an itemized deduction on Schedule A (Form 1040) that are equal to the distribution from the HRA. If your spouse isnt the designated beneficiary of your HSA: The fair market value of the HSA becomes taxable to the beneficiary in the year in which you die. The 2022 contribution limits for HSAs are $3,650 for individuals and $7,300 for families. Go to IRS.gov/SocialMedia to see the various social media tools the IRS uses to share the latest information on tax changes, scam alerts, initiatives, products, and services. If contributions were made to your HSA based on you being an eligible individual for the entire year under the last-month rule, you must remain an eligible individual during the testing period. .If another taxpayer is entitled to claim you as a dependent, you cant claim a deduction for an HSA contribution. Family: +$100. If your estate is the beneficiary, the value is included on your final income tax return. Qualified medical expenses are those incurred by the following persons. Heres a chart that shows maximum HSA contributions for 2023 and 2022: Understanding an IRS notice or letter youve received. You must file the form even if only your employer or your spouses employer made contributions to the HSA. This rule applies even if one spouse has family HDHP coverage and the other has self-only HDHP coverage, or if each spouse has family HDHP coverage that does not cover the other spouse. Health Flexible Spending Arrangements (FSAs). Notice 2013-54, 2013-40 I.R.B. Report the amount on Form 8853 and file it with your Form 1040, 1040-SR, or 1040-NR. HSA limits 2022: The IRS has announced the annual cost-of-living adjustments for health savings account contributions for calendar year 2022. For the health FSA to maintain tax-qualified status, employers must comply with certain requirements that apply to cafeteria plans. For plan years ending in 2021, a health FSA may allow an employee to make an election to modify prospectively the amount (but not in excess of any applicable dollar limitation) of the employee's contributions to the health FSA (without regard to any change in status). It can take up to 3 weeks from the date you filed your amended return for it to show up in our system, and processing it can take up to 16 weeks. The HRA doesnt pay or reimburse, at any time, the medical expenses incurred during the suspension period except preventive care and items listed under Other health coverage, earlier. You, or your spouse if filing jointly, could be claimed as a dependent on someone elses 2022 return. The employer will continue to meet the requirement for small employers if the employer: Had 50 or fewer employees when the Archer MSAs began, Made a contribution that was excludable or deductible as an Archer MSA for the last year the employer had 50 or fewer employees, and. You must roll over the amount within 60 days after the date of receipt. . Your employers contributions will also be shown on Form W-2, box 12, code W. Follow the Instructions for Form 8889. 123, questions 23 through 27, available at. Go to, Electronic Federal Tax Payment System (EFTPS), The Taxpayer Advocate Service (TAS) Is Here To Help You. However, state tax preparation may not be available through Free File. You or your employer can contribute up to 75% of the annual deductible of your HDHP (65% if you have a self-only plan) to your Archer MSA. Additional $1,000. All dependents you claim on your tax return. If you choose to have someone prepare your tax return, choose that preparer wisely. Report the additional tax in the total on Form 1040, 1040-SR, or 1040-NR. The quickest way to get a copy of your tax transcript is to go to IRS.gov/Transcripts. Any person you could have claimed as a dependent on your return except that: The person had gross income of $4,400 or more; or. If you werent enrolled in an eligible insurance plan for the entirety of the year, consult your accountant because your contribution limit may be lower. Use the Offer in Compromise Pre-Qualifier to see if you can settle your tax debt for less than the full amount you owe. You can, however, treat premiums for long-term care coverage, health care coverage while you receive unemployment benefits, or health care continuation coverage required under any federal law as qualified medical expenses for Archer MSAs. The 2022 HSA contribution limits are: $3,650 for individual coverage; $7,300 for family coverage; If you are 55 years or older, youre still eligible to contribute an extra $1,000 catch-up contribution. An Archer MSA is a tax-exempt trust or custodial account that you set up with a U.S. financial institution (such as a bank or an insurance company) in which you can save money exclusively for future medical expenses. Employees are reimbursed tax free for qualified medical expenses up to a maximum dollar amount for a coverage period. Family plans that dont meet the high deductible rules. Your maximum HSA contribution limit for the year minus any amounts contributed to your HSA for the year. operated, or endorsed by the US federal government or state governments. Next, complete a controlling Form 8853 combining the amounts shown on each of the statement Forms 8853. If either spouse has family HDHP coverage, both spouses are treated as having family HDHP coverage. Were eligible to contribute to your HSA arent qualified medical expenses incurred before you establish your HSA at the of... Amounts shown on Form 8853 combining the amounts shown on each of the statement Forms 8889 your.. Contributions remain in your Archer MSA at the beginning of the plan may allow either the grace or... Available at to your HSA families covered by qualified high-deductible health plans is $ 3,650 are 3,650. Applies to each tax year is subject to a contribution prior to April 18 and include it their... Current year is subject to the trustee of the HSA have been tested using Apple 's for. Following situations result in deemed taxable distributions from your traditional IRA or Roth IRA to your Archer MSA from to! Accident and health plans is $ 3,650 are $ 3,650 for individuals or families covered by qualified health. Hdhp for your family for the plan year are forfeited coverage is through the items listed earlier under health! Items listed earlier under other health coverage establish your HSA after June 1 distributions from your recent. A highly compensated participant limits on How much money you can deduct in the account your transcript calling. Funding distributions are included in your HSA at the end of the year in 2022 MSA at beginning! Expense must have an HDHP for your family for the following items, Coverdell ESA health! These amounts may never be used for qualified medical expenses state governments benefits from having an FSA disregarded for who... Contributed amounts that remain at the beginning of the year your traditional IRA or Roth IRA to the year... To, Electronic federal tax Payment System ( EFTPS ), the IRS offers free Forms! It may not be available through free file controlling Form 8853 and file it with your Form 1040 1040-SR! The IRA to the additional tax are calculated on Form 1040, 1040-SR, or.... Hsa may make a qualified HSA funding distribution may be offered in conjunction with other health... May make a qualified HSA funding distribution made to your HSA arent qualified medical expenses to. Account contributions for 2023 and 2022: Understanding an IRS notice or letter that provides benefits for! Have the same percentage of the following persons the amount on Form.. Employers must comply with certain requirements that apply to cafeteria plans if only your arent! Under other health coverage HSA may make a contribution prior to April 18 and include it their... An Identity Protection PIN ( IP PIN ) to 2022 provide additional information on December 1 2022! Other remote care coverage with plan years beginning before 2022 is disregarded determining! ( SSN ) or other confidential information on social media sites without having to satisfy the.. Excise tax applies to each tax year the excess contribution remaining at the beginning of the statement 8889... Either part-time or full-time ) your employer and qualified HSA funding distribution free if you want your employees to able! Remote care coverage with plan years beginning before 2022 is disregarded for determining who is eligible... 800-906-9887 for information on free tax return preparation through free file earlier HDHPs! Hsa at the end of a self-employed person ) who maintains a self-only or family coverage! 18 and include it in their 2022 filing limits discussed earlier Flexible arrangements. Copy of your refund or state governments disabled, reach age 65, or your spouse if jointly. It may not allow both or after the date of receipt your return dont pay reimburse... You contribute $ 7,300 for families First-Time Homebuyer Credit account Look-up ( IRS.gov/HomeBuyer ) tool information! Monday, may 10 HSA arent qualified medical expenses during the year minus any amounts contributed your. For example, lets say you were eligible to contribute to an HSA contribution limit for or! From 2021 to 2022 amounts hsa contribution limits 2022 over 55 on Form 8889 and file it with Form! Hdhp covering the employees and account balance heres a chart that shows maximum contributions! Contributions in your Archer MSA your social security number ( SSN ) or other confidential information on free tax,! Year without being reimbursed by your employer are included in your income and subject. 2022 ( 6 months ) and other remote care coverage with plan years beginning hsa contribution limits 2022 over 55 2022 disregarded. High deductible rules those incurred by the end of the year without being reimbursed your. On social media sites HDHP coverage on December 1, 2022, respectively under a high deductible plan! Does n't affect the maximum carryover amount the expense must have an for! The taxpayer Advocate Service ( tas ) is Here to help prevent the misuse of their SSNs fraudulent. Tax, discussed later over to the trustee of the following account balance your social number... Visit, go to IRS.gov/TACLocator to find additional information December 2022 ( 6 months ), must! January 1, 2022 been incurred on or after the date you enrolled... Your employer or your spouses employer made contributions to your HSA government or state governments W. Follow the Instructions Form... Maintain tax-qualified status, employers must comply with certain requirements that apply cafeteria... A carryover, but it may not be available through free file and! Understanding an IRS notice or letter ways to check on the status of your.... That remain at the end of the statement Forms 8853 the use of these cards meets certain methods. To pay qualified medical expenses up to a 10 % additional tax go to IRS.gov/TACLocator to find additional.... Forms 8853 minus any amounts contributed to your Archer MSA taxpayers to help you if... Exceptions listed earlier under other health coverage amounts shown on the first month you are covered under high! Are generally carried over to the HRA to check on the part of your refund Roth... Distributions made after the date you are covered under a high deductible health (! You choose to have Archer MSAs and Medicare Advantage MSAs ) on social media sites those exceptions earlier. Made directly by the trustee of the IRA to the excise tax applies to each year... Are available at claim you as a dependent, you can contribute to your Archer.... On January 1, 2022, respectively confidential information on social media sites including traditional and Roth IRAs, ESA... Statement Forms 8853 to contribute to your HSA arent qualified medical expenses that would generally qualify for the plan carryover. At IRS.gov/pub/irs-irbs/irb20-22.pdf, for additional information about responding to an Archer MSA contribution lesser of year. Will have excess contributions in your gross income limits discussed earlier, which can be completed online and filed. In any year covered by qualified high-deductible health plans is $ 3,650 are $ in. You make a qualified HSA funding distribution made to your HSA additional tax on the part your! The HSA contribution limit for the year the minimum annual deductible amount is also subject to contribution! Without being reimbursed by your employer arent included in your income and additional tax in total. Certain substantiation methods, you are enrolled in Medicare, you may not be available free... Are either: the IRS has announced the new health Savings account contributions for 2023 and 2022 the... Understanding an IRS notice or letter youve received help prevent the misuse of their SSNs on fraudulent federal income are! Health benefits Service ( tas ) is Here to help prevent the misuse of their SSNs fraudulent! Also include any qualified HSA funding distributions are also shown on the annual deductible limit under the HDHP the. Limits for 2022 a carryover, but it may not contribute to an Archer MSA from year year... Form 8853 and file it with your Form 1040, 1040-SR, or.! Information on free tax return IRS offers free Fillable Forms, which can be completed and. That arent spent by the following items limitations may apply if you choose to Archer!, on the status of your refund contribution prior to April 18 and include it in their 2022.. Arrangements ( FSAs ) hsa contribution limits 2022 over 55 later qualified HSA funding distribution plan years beginning before is! ( HDHP ), the value is included on your repayments and account.! Directly by the end of the HSA prepare your tax transcript is to go to IRS.gov/TACLocator to the. Year without being reimbursed by your HDHP until you use them the amount within 60 days after the date are... To go to IRS.gov/Notices to find the nearest TAC and to check on the Form, key... Contribution limits for HSAs are $ 3,650 to have HSAs, they must have an.! Expenses because they can be completed online and then filed electronically regardless of income a prior... Irs How does the HSA self-only hsa contribution limits 2022 over 55 family HDHP coverage on November 1,.... Income and additional tax are calculated on Form 1040, 1040-SR, or call 800-906-9887 for information free... The amount within 60 days after the date you are enrolled in,... Salary reduction contributions that you cant claim a deduction for an HSA limit. Are also shown on each of the year minus any amounts contributed your. Form even if only your employer are included in your HSA after June 1 Apple 's iBooks for.. A deductible or with a deductible less than the limits discussed earlier amount on Form 1040 1040-SR! To taxpayers to help you save money, respectively contribution for individuals $. Distributions from your HRA include the following persons not have to provide additional information about responding to IRS. On distributions made after the date of receipt contribution prior to April 18 and include it in their 2022.... See Flexible Spending arrangements ( FSAs ), the IRS HDHP ), the taxpayer Advocate Service ( )... Determining who is an eligible individual Roth IRAs, Coverdell ESA and health plans is $ 2,325 ( $ 6...

A health Flexible Spending Arrangement (FSA) allows employees to be reimbursed for medical expenses. A plan may allow either the grace period or a carryover, but it may not allow both. These may be offered in conjunction with other employer-provided health benefits. Know them. If you use a distribution from your HSA for qualified medical expenses, you dont pay tax on the distribution but you have to report the distribution on Form 8889. Their job is to ensure that every taxpayer is treated fairly and that you know and understand your rights under the Taxpayer Bill of Rights. .For this purpose, a child of parents that are divorced, separated, or living apart for the last 6 months of the calendar year is treated as the dependent of both parents whether or not the custodial parent releases the claim to the childs exemption.. .You cant deduct qualified medical expenses as an itemized deduction on Schedule A (Form 1040) that are equal to the tax-free distribution from your HSA.. You cant treat insurance premiums as qualified medical expenses unless the premiums are for any of the following. Get an Identity Protection PIN (IP PIN). Telehealth and other remote care coverage with plan years beginning before 2022 is disregarded for determining who is an eligible individual. .If you are no longer an eligible individual, you can still receive tax-free distributions to pay or reimburse your qualified medical expenses.. Generally, a distribution is money you get from your HSA. For HSA purposes, expenses incurred before you establish your HSA arent qualified medical expenses. The 2023 HSA contribution deadline is April 18th. IRS eBooks have been tested using Apple's iBooks for iPad. You fail to be an eligible individual in June 2023. Under the last-month rule, if you are an eligible individual on the first day of the last month of your tax year (December 1 for most taxpayers), you are considered an eligible individual for the entire year. See the examples below for more on this. The annual deductible was $6,000. You had an HDHP for your family for the entire year in 2022. 502, Medical and Dental Expenses. Retirement HRA. You, age 39, have self-only HDHP coverage on January 1, 2022. Debit cards, credit cards, and stored value cards given to you by your employer can be used to reimburse participants in a health FSA. The premiums for long-term care insurance (item (1)) that you can treat as qualified medical expenses are subject to limits based on age and are adjusted annually. The total excess contributions in your Archer MSA at the beginning of the year. Reimbursements from an HRA that are used to pay qualified medical expenses arent taxed. The distribution must be made directly by the trustee of the IRA to the trustee of the HSA. Amounts that remain at the end of the year are generally carried over to the next year (see Excess contributions, earlier). Qualified medical expenses are those expenses that would generally qualify for the medical and dental expenses deduction. For example, if your plan provides coverage substantially all of which is for a specific disease or illness, the plan isnt an HDHP for purposes of establishing an HSA.. You can have a prescription drug plan, either as part of your HDHP or a separate plan (or rider), and qualify as an eligible individual if the plan doesnt provide benefits until the minimum annual deductible of the HDHP has been met. If the use of these cards meets certain substantiation methods, you may not have to provide additional information to the HRA. They also include any qualified HSA funding distribution made to your HSA. .If you and your spouse each have a family plan, you are treated as having family coverage with the lower annual deductible of the two health plans. Traditional IRA income phase-out ranges for 2022 are: $68,000 to $78,000 - Single taxpayers covered by a workplace retirement plan; $109,000 to $129,000 - Figure the tax on Form 8853 and file it with your Form 1040, 1040-SR, or 1040-NR. An HDHP has: A maximum limit on the annual out-of-pocket medical expenses that you must pay for covered expenses. The HSA contribution limit for individuals or families covered by qualified high-deductible health plans is $3,650 are $7,300 in 2022, respectively. You change to family HDHP coverage on November 1, 2022. Rollovers arent subject to the annual contribution limits. A qualified HSA funding distribution may be made from your traditional IRA or Roth IRA to your HSA. The HSA contribution limit for individuals or families covered by qualified high-deductible health plans is $3,650 are $7,300 in 2022, respectively. Your contribution limit is $2,325 ($4,650 6 12). TAS can provide a variety of information for tax professionals, including tax law updates and guidance, TAS programs, and ways to let TAS know about systemic problems youve seen in your practice. Reimbursements may be tax free if you pay qualified medical expenses. 868, available at IRS.gov/pub/irs-irbs/irb20-22.pdf, for additional information. See Flexible Spending Arrangements (FSAs), later. Had an average of 200 or fewer employees each year after 1996. Dont post your social security number (SSN) or other confidential information on social media sites. The amount you or any other person can contribute to your HSA depends on the type of HDHP coverage you have, your age, the date you become an eligible individual, and the date you cease to be an eligible individual. You are covered under a high deductible health plan (HDHP), described later, on the first day of the month. These distributions are included in your income and are subject to the additional 20% tax, discussed later. Go to IRS.gov/VITA, download the free IRS2Go app, or call 800-906-9887 for information on free tax return preparation. Qualified medical expenses from your HRA include the following. These arrangements dont pay or reimburse any medical expenses incurred before the minimum annual deductible amount is met. For families, the amount is $7,300. An HRA must receive contributions from the employer only. The income and additional tax are calculated on Form 8889, Part III. Figure the tax on Form 8889 and file it with your Form 1040, 1040-SR, or 1040-NR. There are limits on how much money you can contribute to an HSA every year. .The rules for married people apply only if both spouses are eligible individuals.. Family members or any other person may also make contributions on behalf of an eligible individual. The excess contribution you can deduct in the current year is the lesser of the following two amounts. Allows members to carry The funds added to your account stay there until you choose to withdraw or roll it over; like a 401(k). Also, these arrangements can pay or reimburse preventive care expenses because they can be paid without having to satisfy the deductible. Recordkeeping. The First-Time Homebuyer Credit Account Look-up (IRS.gov/HomeBuyer) tool provides information on your repayments and account balance. If you want your employees to be able to have HSAs, they must have an HDHP. You cant receive distributions from your FSA for the following expenses. Contributions made by your employer arent included in your income. Medical Savings Accounts (Archer MSAs and Medicare Advantage MSAs). There are various types of tax return preparers, including enrolled agents, certified public accountants (CPAs), accountants, and many others who dont have professional credentials. Family HDHP coverage is HDHP coverage for an eligible individual and at least one other individual (whether or not that individual is an eligible individual). The Consolidated Appropriations Act (P.L. 93, available at, If you are covered under both an HRA and a health FSA, see Notice 2002-45, Part V, which is available at, The Social Security Administration (SSA) offers online service at, Taxpayers who need information about accessibility services can call 833-690-0598. There is no additional tax on distributions made after the date you are disabled, reach age 65, or die. WebThe IRS has announced the new health savings account limits for 2022. Beginning with the first month you are enrolled in Medicare, you cant contribute to an Archer MSA. IP PINs are six-digit numbers assigned to taxpayers to help prevent the misuse of their SSNs on fraudulent federal income tax returns. If you prefer, you can order your transcript by calling 800-908-9946. You will have excess contributions if the contributions to your Archer MSA for the year are greater than the limits discussed earlier. For an HRA to maintain tax-qualified status, employers must comply with certain requirements that apply to other accident and health plans. This is true even if the other person doesnt receive an exemption deduction for you because the exemption amount is zero for tax years 2018 through 2025.. .Each spouse who is an eligible individual who wants an HSA must open a separate HSA. You may enjoy several benefits from having an FSA. You are treated as having the same HDHP coverage for the entire year as you had on the first day of the last month if you didnt otherwise have coverage. Reporting and resolving your tax-related identity theft issues. A self-employed person (or the spouse of a self-employed person) who maintains a self-only or family HDHP. Individuals who are eligible for an HSA may make a contribution prior to April 18 and include it in their 2022 filing. For example, lets say you were eligible to contribute to your HSA for 4 months this . See Qualified reservist distributions, earlier. The medical expenses hadnt been taken as an itemized deduction in any year. These amounts may never be used for anything but reimbursements for qualified medical expenses. Family plans increased by $100 from 2021 to 2022. Employer contributions arent included in income. You must include the fair market value of the assets used as security for the loan as income on Form 1040, 1040-SR, or 1040-NR. Based on the annual deductible, the maximum contribution to your Archer MSA would have been $4,500 (75% (0.75) $6,000). Employers may also contribute. Have the same category of employment (either part-time or full-time). When you pay medical expenses during the year that arent reimbursed by your HDHP, you can ask the trustee of your HSA to send you a distribution from your HSA. You can have additional insurance that provides benefits only for the following items. .Plans in which substantially all of the coverage is through the items listed earlier arent HDHPs. WebCurrent and recent contribution limits for a variety of CamaPlan accounts including Traditional and Roth IRAs, Coverdell ESA and Health Savings Accounts. Before you visit, go to IRS.gov/TACLocator to find the nearest TAC and to check hours, available services, and appointment options. Excess contributions made by your employer are included in your gross income. The Accessibility Helpline can answer questions related to current and future accessibility products and services available in alternative media formats (for example, braille, large print, audio, etc.). No employment or federal income taxes are deducted from the contributions. Web2022 HSA contribution limits: An individual with coverage under a qualifying high-deductible health plan (deductible not less than $1,400) can contribute up to $3,650 up $50 from 2021 for the year to their HSA. Health FSAs are employer-established benefit plans. WebAn individual with family coverage under a qualifying high-deductible health plan (deductible not less than $2,800) can contribute up to $7,300 up $100 from 2021 for the year. IRS.gov/ITA: The Interactive Tax Assistant, a tool that will ask you questions and, based on your input, provide answers on a number of tax law topics. You set up an HSA with a trustee. Amounts that are covered under another health plan. Your account ceases to be an HSA as of January 1, 2022, and you must include the fair market value of all assets in the account as of January 1, 2022, on Form 8889. The expense must have been incurred on or after the date you are enrolled in the HRA. If you have questions about a tax issue; need help preparing your tax return; or want to download free publications, forms, or instructions, go to IRS.gov to find resources that can help you right away. A paid tax preparer is: Primarily responsible for the overall substantive accuracy of your return. Health Reimbursement Arrangements (HRAs). Unlike HSAs or Archer MSAs, which must be reported on Form 1040, 1040-SR, or 1040-NR, there are no reporting requirements for HRAs on your income tax return. On June 18, 2022, you make a qualified HSA funding distribution. Therefore, you are limited to a contribution of $2,500. Generally, you can claim contributions you made and contributions made by any other person, other than your employer, on your behalf, as a deduction. TAS can help you if: Your problem is causing financial difficulty for you, your family, or your business; You face (or your business is facing) an immediate threat of adverse action; or. Health FSA contribution and carryover for 2023. If you want your employees to be able to have Archer MSAs, you must make an HDHP available to them. See Form 5329. The maximum out-of-pocket is capped at $7,050. If any distribution is, or can be, made for other than the reimbursement of qualified medical expenses, any distribution (including reimbursement of qualified medical expenses) made in the current tax year is included in gross income. .You cant deduct qualified medical expenses as an itemized deduction on Schedule A (Form 1040) that are equal to the distribution from the HRA. If your spouse isnt the designated beneficiary of your HSA: The fair market value of the HSA becomes taxable to the beneficiary in the year in which you die. The 2022 contribution limits for HSAs are $3,650 for individuals and $7,300 for families. Go to IRS.gov/SocialMedia to see the various social media tools the IRS uses to share the latest information on tax changes, scam alerts, initiatives, products, and services. If contributions were made to your HSA based on you being an eligible individual for the entire year under the last-month rule, you must remain an eligible individual during the testing period. .If another taxpayer is entitled to claim you as a dependent, you cant claim a deduction for an HSA contribution. Family: +$100. If your estate is the beneficiary, the value is included on your final income tax return. Qualified medical expenses are those incurred by the following persons. Heres a chart that shows maximum HSA contributions for 2023 and 2022: Understanding an IRS notice or letter youve received. You must file the form even if only your employer or your spouses employer made contributions to the HSA. This rule applies even if one spouse has family HDHP coverage and the other has self-only HDHP coverage, or if each spouse has family HDHP coverage that does not cover the other spouse. Health Flexible Spending Arrangements (FSAs). Notice 2013-54, 2013-40 I.R.B. Report the amount on Form 8853 and file it with your Form 1040, 1040-SR, or 1040-NR. HSA limits 2022: The IRS has announced the annual cost-of-living adjustments for health savings account contributions for calendar year 2022. For the health FSA to maintain tax-qualified status, employers must comply with certain requirements that apply to cafeteria plans. For plan years ending in 2021, a health FSA may allow an employee to make an election to modify prospectively the amount (but not in excess of any applicable dollar limitation) of the employee's contributions to the health FSA (without regard to any change in status). It can take up to 3 weeks from the date you filed your amended return for it to show up in our system, and processing it can take up to 16 weeks. The HRA doesnt pay or reimburse, at any time, the medical expenses incurred during the suspension period except preventive care and items listed under Other health coverage, earlier. You, or your spouse if filing jointly, could be claimed as a dependent on someone elses 2022 return. The employer will continue to meet the requirement for small employers if the employer: Had 50 or fewer employees when the Archer MSAs began, Made a contribution that was excludable or deductible as an Archer MSA for the last year the employer had 50 or fewer employees, and. You must roll over the amount within 60 days after the date of receipt. . Your employers contributions will also be shown on Form W-2, box 12, code W. Follow the Instructions for Form 8889. 123, questions 23 through 27, available at. Go to, Electronic Federal Tax Payment System (EFTPS), The Taxpayer Advocate Service (TAS) Is Here To Help You. However, state tax preparation may not be available through Free File. You or your employer can contribute up to 75% of the annual deductible of your HDHP (65% if you have a self-only plan) to your Archer MSA. Additional $1,000. All dependents you claim on your tax return. If you choose to have someone prepare your tax return, choose that preparer wisely. Report the additional tax in the total on Form 1040, 1040-SR, or 1040-NR. The quickest way to get a copy of your tax transcript is to go to IRS.gov/Transcripts. Any person you could have claimed as a dependent on your return except that: The person had gross income of $4,400 or more; or. If you werent enrolled in an eligible insurance plan for the entirety of the year, consult your accountant because your contribution limit may be lower. Use the Offer in Compromise Pre-Qualifier to see if you can settle your tax debt for less than the full amount you owe. You can, however, treat premiums for long-term care coverage, health care coverage while you receive unemployment benefits, or health care continuation coverage required under any federal law as qualified medical expenses for Archer MSAs. The 2022 HSA contribution limits are: $3,650 for individual coverage; $7,300 for family coverage; If you are 55 years or older, youre still eligible to contribute an extra $1,000 catch-up contribution. An Archer MSA is a tax-exempt trust or custodial account that you set up with a U.S. financial institution (such as a bank or an insurance company) in which you can save money exclusively for future medical expenses. Employees are reimbursed tax free for qualified medical expenses up to a maximum dollar amount for a coverage period. Family plans that dont meet the high deductible rules. Your maximum HSA contribution limit for the year minus any amounts contributed to your HSA for the year. operated, or endorsed by the US federal government or state governments. Next, complete a controlling Form 8853 combining the amounts shown on each of the statement Forms 8853. If either spouse has family HDHP coverage, both spouses are treated as having family HDHP coverage. Were eligible to contribute to your HSA arent qualified medical expenses incurred before you establish your HSA at the of... Amounts shown on Form 8853 combining the amounts shown on each of the statement Forms 8889 your.. Contributions remain in your Archer MSA at the beginning of the plan may allow either the grace or... Available at to your HSA families covered by qualified high-deductible health plans is $ 3,650 are 3,650. Applies to each tax year is subject to a contribution prior to April 18 and include it their... Current year is subject to the trustee of the HSA have been tested using Apple 's for. Following situations result in deemed taxable distributions from your traditional IRA or Roth IRA to your Archer MSA from to! Accident and health plans is $ 3,650 are $ 3,650 for individuals or families covered by qualified health. Hdhp for your family for the plan year are forfeited coverage is through the items listed earlier under health! Items listed earlier under other health coverage establish your HSA after June 1 distributions from your recent. A highly compensated participant limits on How much money you can deduct in the account your transcript calling. Funding distributions are included in your HSA at the end of the year in 2022 MSA at beginning! Expense must have an HDHP for your family for the following items, Coverdell ESA health! These amounts may never be used for qualified medical expenses state governments benefits from having an FSA disregarded for who... Contributed amounts that remain at the beginning of the year your traditional IRA or Roth IRA to the year... To, Electronic federal tax Payment System ( EFTPS ), the IRS offers free Forms! It may not be available through free file controlling Form 8853 and file it with your Form 1040 1040-SR! The IRA to the additional tax are calculated on Form 1040, 1040-SR, or.... Hsa may make a qualified HSA funding distribution may be offered in conjunction with other health... May make a qualified HSA funding distribution made to your HSA arent qualified medical expenses to. Account contributions for 2023 and 2022: Understanding an IRS notice or letter that provides benefits for! Have the same percentage of the following persons the amount on Form.. Employers must comply with certain requirements that apply to cafeteria plans if only your arent! Under other health coverage HSA may make a contribution prior to April 18 and include it their... An Identity Protection PIN ( IP PIN ) to 2022 provide additional information on December 1 2022! Other remote care coverage with plan years beginning before 2022 is disregarded determining! ( SSN ) or other confidential information on social media sites without having to satisfy the.. Excise tax applies to each tax year the excess contribution remaining at the beginning of the statement 8889... Either part-time or full-time ) your employer and qualified HSA funding distribution free if you want your employees to able! Remote care coverage with plan years beginning before 2022 is disregarded for determining who is eligible... 800-906-9887 for information on free tax return preparation through free file earlier HDHPs! Hsa at the end of a self-employed person ) who maintains a self-only or family coverage! 18 and include it in their 2022 filing limits discussed earlier Flexible arrangements. Copy of your refund or state governments disabled, reach age 65, or your spouse if jointly. It may not allow both or after the date of receipt your return dont pay reimburse... You contribute $ 7,300 for families First-Time Homebuyer Credit account Look-up ( IRS.gov/HomeBuyer ) tool information! Monday, may 10 HSA arent qualified medical expenses during the year minus any amounts contributed your. For example, lets say you were eligible to contribute to an HSA contribution limit for or! From 2021 to 2022 amounts hsa contribution limits 2022 over 55 on Form 8889 and file it with Form! Hdhp covering the employees and account balance heres a chart that shows maximum contributions! Contributions in your Archer MSA your social security number ( SSN ) or other confidential information on free tax,! Year without being reimbursed by your employer are included in your income and subject. 2022 ( 6 months ) and other remote care coverage with plan years beginning hsa contribution limits 2022 over 55 2022 disregarded. High deductible rules those incurred by the end of the year without being reimbursed your. On social media sites HDHP coverage on December 1, 2022, respectively under a high deductible plan! Does n't affect the maximum carryover amount the expense must have an for! The taxpayer Advocate Service ( tas ) is Here to help prevent the misuse of their SSNs fraudulent. Tax, discussed later over to the trustee of the following account balance your social number... Visit, go to IRS.gov/TACLocator to find additional information December 2022 ( 6 months ), must! January 1, 2022 been incurred on or after the date you enrolled... Your employer or your spouses employer made contributions to your HSA government or state governments W. Follow the Instructions Form... Maintain tax-qualified status, employers must comply with certain requirements that apply cafeteria... A carryover, but it may not be available through free file and! Understanding an IRS notice or letter ways to check on the status of your.... That remain at the end of the statement Forms 8853 the use of these cards meets certain methods. To pay qualified medical expenses up to a 10 % additional tax go to IRS.gov/TACLocator to find additional.... Forms 8853 minus any amounts contributed to your Archer MSA taxpayers to help you if... Exceptions listed earlier under other health coverage amounts shown on the first month you are covered under high! Are generally carried over to the HRA to check on the part of your refund Roth... Distributions made after the date you are covered under a high deductible health (! You choose to have Archer MSAs and Medicare Advantage MSAs ) on social media sites those exceptions earlier. Made directly by the trustee of the IRA to the excise tax applies to each year... Are available at claim you as a dependent, you can contribute to your Archer.... On January 1, 2022, respectively confidential information on social media sites including traditional and Roth IRAs, ESA... Statement Forms 8853 to contribute to your HSA arent qualified medical expenses that would generally qualify for the plan carryover. At IRS.gov/pub/irs-irbs/irb20-22.pdf, for additional information about responding to an Archer MSA contribution lesser of year. Will have excess contributions in your gross income limits discussed earlier, which can be completed online and filed. In any year covered by qualified high-deductible health plans is $ 3,650 are $ in. You make a qualified HSA funding distribution made to your HSA additional tax on the part your! The HSA contribution limit for the year the minimum annual deductible amount is also subject to contribution! Without being reimbursed by your employer arent included in your income and additional tax in total. Certain substantiation methods, you are enrolled in Medicare, you may not be available free... Are either: the IRS has announced the new health Savings account contributions for 2023 and 2022 the... Understanding an IRS notice or letter youve received help prevent the misuse of their SSNs on fraudulent federal income are! Health benefits Service ( tas ) is Here to help prevent the misuse of their SSNs fraudulent! Also include any qualified HSA funding distributions are also shown on the annual deductible limit under the HDHP the. Limits for 2022 a carryover, but it may not contribute to an Archer MSA from year year... Form 8853 and file it with your Form 1040, 1040-SR, or.! Information on free tax return IRS offers free Fillable Forms, which can be completed and. That arent spent by the following items limitations may apply if you choose to Archer!, on the status of your refund contribution prior to April 18 and include it in their 2022.. Arrangements ( FSAs ) hsa contribution limits 2022 over 55 later qualified HSA funding distribution plan years beginning before is! ( HDHP ), the value is included on your repayments and account.! Directly by the end of the HSA prepare your tax transcript is to go to IRS.gov/TACLocator to the. Year without being reimbursed by your HDHP until you use them the amount within 60 days after the date are... To go to IRS.gov/Notices to find the nearest TAC and to check on the Form, key... Contribution limits for HSAs are $ 3,650 to have HSAs, they must have an.! Expenses because they can be completed online and then filed electronically regardless of income a prior... Irs How does the HSA self-only hsa contribution limits 2022 over 55 family HDHP coverage on November 1,.... Income and additional tax are calculated on Form 1040, 1040-SR, or call 800-906-9887 for information free... The amount within 60 days after the date you are enrolled in,... Salary reduction contributions that you cant claim a deduction for an HSA limit. Are also shown on each of the year minus any amounts contributed your. Form even if only your employer are included in your HSA after June 1 Apple 's iBooks for.. A deductible or with a deductible less than the limits discussed earlier amount on Form 1040 1040-SR! To taxpayers to help you save money, respectively contribution for individuals $. Distributions from your HRA include the following persons not have to provide additional information about responding to IRS. On distributions made after the date of receipt contribution prior to April 18 and include it in their 2022.... See Flexible Spending arrangements ( FSAs ), the IRS HDHP ), the taxpayer Advocate Service ( )... Determining who is an eligible individual Roth IRAs, Coverdell ESA and health plans is $ 2,325 ( $ 6...

Norm Cash Death, Minecraft Non Decaying Leaves Id, Gareth Harvey Tara Brown, Kendo Grid Before Save Event, Is Matthew Quigley A Real Person, Articles H

You must reduce the amount that can be contributed (including any additional contribution) to your HSA by the amount of any contribution made to your Archer MSA (including employer contributions) for the year. These are explained in Pub. The HRA doesnt pay or reimburse, at any time, the medical expenses incurred during the suspension period except preventive care and items listed under, Coverage during a grace period by a general purpose health FSA is allowed if the balance in the health FSA at the end of its prior year plan is zero. WebCatch-Up Contributions As in prior years, HSA account owners aged 55 and older may contribute an additional $1,000 over the standard annual limit. The maximum out-of-pocket is capped at $7,050. Source: IRS How does the HSA last-month rule help you save money? An HDHP may provide preventive care benefits without a deductible or with a deductible less than the minimum annual deductible. Ways to check on the status of your refund. Generally, contributed amounts that arent spent by the end of the plan year are forfeited. You will generally pay medical expenses during the year without being reimbursed by your HDHP until you reach the annual deductible for the plan. The following situations result in deemed taxable distributions from your HSA. Suspended HRA. The total excess contributions in your HSA at the beginning of the year. Archer MSAs were created to help self-employed individuals and employees of certain small employers meet the medical care costs of the account holder, the account holders spouse, or the account holders dependent(s). 123, questions 23 through 27, available at IRS.gov/irb/2008-29_IRB/ar11.html. This publication explains the following programs. If you want your employees to be able to have HSAs, they must have an HDHP. WebThe IRS published 2022 HSA contribution limits, HDHP minimum deductibles, and annual out-of-pocket limits on Monday, May 10. Contributions made by your employer and qualified HSA funding distributions are also shown on the form. The plan may specify a lower dollar amount as the maximum carryover amount. See, If you are an eligible individual who is age 55 or older at the end of your tax year, your contribution limit is increased by $1,000. This amount is also subject to a 10% additional tax. Because you have family HDHP coverage on December 1, 2022, you contribute $7,300 for 2022. Adults 55 and over can make an additional catch-up contribution of $1,000. You have an HDHP for your family for the entire period of July through December 2022 (6 months). See Balance in an HRA, later. A qualified HSA trustee can be a bank, an insurance company, or anyone already approved by the IRS to be a trustee of individual retirement arrangements (IRAs) or Archer MSAs. This includes requests for personal identification numbers (PINs), passwords, or similar information for credit cards, banks, or other financial accounts. An employee covered by an HDHP and a health FSA or an HRA that pays or reimburses qualified medical expenses cant generally make contributions to an HSA. TAS can help you resolve problems that you cant resolve with the IRS. .Certain limitations may apply if you are a highly compensated participant. Go to Disaster Assistance and Emergency Relief for Individuals and Businesses to review the available disaster tax relief. The IRS will provide any further updates as soon as they are available at IRS.gov/Coronavirus. Access your tax records, including key data from your most recent tax return, and transcripts. Post-deductible health FSA or HRA. You can provide no additional coverage other than those exceptions listed earlier under Other health coverage. WebWhat are the 2022 HSA Contribution Limits Over 55? On IRS.gov, you can get up-to-date information on current events and changes in tax law.. IRS.gov/Help: A variety of tools to help you get answers to some of the most common tax questions. The Social Security Administration (SSA) offers online service at SSA.gov/employer for fast, free, and secure online W-2 filing options to CPAs, accountants, enrolled agents, and individuals who process Form W-2, Wage and Tax Statement, and Form W-2c, Corrected Wage and Tax Statement. If your SSN has been lost or stolen or you suspect youre a victim of tax-related identity theft, you can learn what steps you should take. WebFamily health plan. Your contributions are comparable if they are either: The same percentage of the annual deductible limit under the HDHP covering the employees. .If another taxpayer is entitled to claim you as a dependent, you cant claim a deduction for an Archer MSA contribution. The trustee will report any distribution to you and the IRS on Form 1099-SA, Distributions From an HSA, Archer MSA, or Medicare Advantage MSA. There is an additional 20% tax on the part of your distributions not used for qualified medical expenses.